MINNEAPOLIS – As Americans evaluate their finances during these challenging times, many financial professionals may be missing opportunities to shift conversations about retirement from accumulation to protection. The new 2020 Retirement Risk Readiness Study from Allianz Life Insurance Company of North America (Allianz Life) surveyed three categories of Americans to get different perspectives on retirement: pre-retirees (those 10 years or more from retirement); near-retirees (those within 10 years of retirement); and those who are already retired. The findings reveal gaps in conversations with financial professionals that can help clients protect their retirement assets from some of the risks that can derail savings strategies.

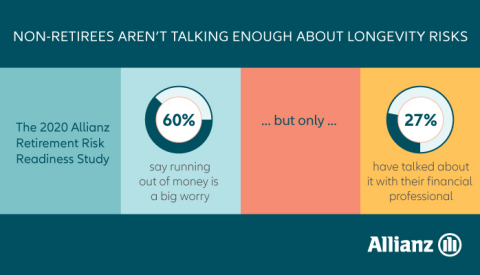

Although people who have already retired are fairly confident about how long their money will last, six in 10 non-retirees said running out of money before they die is one of their biggest concerns. But unfortunately, only about a quarter (27%) of non-retirees who work with a financial professional have discussed this aspect of longevity risk and less than 15% have shared their concerns that they won’t have enough money to do the things they want in retirement.

As it pertains to saving for retirement, many non-retirees seem to understand steps they need to take, but aren’t following through. More than half (55%) of non-retirees said they are worried they won’t have enough saved for retirement and nearly one-third (31%) say they are way too far behind on retirement goals to be able to catch up in time. Yet only 12% said setting long-term financial goals is their top priority and merely 6% identified developing a formal plan with a financial professional as their top priority.

“These responses show there may be a reluctance or lack of opportunity for clients to share the concerns they worry about most in the conversations they are having with their financial professionals,” said Kelly LaVigne, vice president of Consumer Insights, Allianz Life. “Financial professionals may need to be more proactive in discussing these issues and find ways to make clients share more openly so we can develop appropriate solutions.”

Impacts of market volatility

Americans also have significant anxiety about the effects market volatility can have on their retirement savings. Even prior to this current period of extreme market volatility, both retired and non-retired people noted market risk as a top concern, with nearly half (49%) of all respondents identifying a stock market drop as the greatest threat to their retirement income.

Despite this fear of a market downturn that could damage their accounts, less than 30% of Americans who work with a financial professional said they had discussed risks to their retirement arising from market drops, including only 22% of those within 10 years of retirement.

“Although market volatility is top of mind right now, it seems surprising that discussions about volatility and ways to mitigate that risk don’t happen with regularity,” noted LaVigne. “It’s important that we continue to discuss different options for protecting against market volatility with clients, even during times when markets are performing well.”

Addressing the rising cost of living

Inflation is also a key concern, with nearly half (48%) of Americans viewing inflation as a threat to their ability to afford basic expenses in retirement. More than half (59%) also said they are worried that the rising cost of living will prevent them from enjoying their retirement, with the greatest concern (67%) coming from those 10 years or more from retirement (versus 59% for near-retirees and 40% for retirees).

Yet, among those who work with a financial professional, only around two in 10 are having discussions about the impact of inflation and how it can prevent them from enjoying their retirement.

“Simply put, we need to ask ourselves as financial professionals how we can move conversations about retirement beyond accumulation strategies to focus more on how to protect a client’s hard-earned savings from retirement risks that may jeopardize their financial future,” added LaVigne. “It’s crucial that we acknowledge the different challenges that are keeping clients up at night and build these risk-based discussions into the regular planning process.”

*Allianz Life conducted an online survey, the 2020 Retirement Risk Readiness Study, in January 2020 with a nationally representative sample of 1,000 individuals age 25+ in the contiguous USA with an annual household income of $50k+ (single) / $75k+ (married/partnered) OR investable assets of $150k.

About Allianz Life Insurance Company of North America

Allianz Life Insurance Company of North America, one of the FORTUNE 100 Best Companies to Work For® and one of the Ethisphere 2020 World’s Most Ethical Companies®, has been keeping its promises since 1896 by helping Americans achieve their retirement income and protection goals with a variety of annuity and life insurance products. In 2019, Allianz Life provided additional value to its policyholders via distributions of more than $10.4 billion. As a leading provider of fixed index annuities, Allianz Life is part of Allianz SE, a global leader in the financial services industry with over 147,000 employees in more than 70 countries. Allianz Life is a proud sponsor of Allianz Field in St. Paul, Minnesota, home of Major League Soccer’s Minnesota United.