The talent gap within the insurance industry has become legend, as insurers have struggled to recruit and retain the next generation of talent. A decade ago, we faced the impending reality of the baby boomer generation retiring from insurance and our businesses not having sufficient resources to replace these specialized and skilled professionals. Where do we stand now?

The pandemic temporarily changed the outlook of the insurance industry. Remote work and a challenging business climate led to many baby boomers coming out of or delaying their retirement. Today, we find ourselves in old-yet-familiar territory facing the same challenge, with fewer than one in four insurance professionals under the age of 25 and the U.S. Bureau of Labor Statistics estimating that over 50% of the current insurance workforce will retire.

Our industry is more involved and competitive in the talent landscape now, as our businesses have become more conscientiousness of recruiting shortcomings. However, we will still have significant work to do if we are to fill vital roles that all-too-soon may be vacant. What steps can we take as an industry to better our talent recruitment and retention efforts? It starts with improving and broadening our recruiting practices and opening up your agency to a wider range of talent.

Identifying the Right Talent

Replacing a retiring workforce can be difficult; more so if you do not fully understand both your current and future talent needs. For example, at SIAA, we hire based on our core values: persistency, positivity, solution-driven, humility, authenticity, and intellectual curiosity. We have found the most successful people in our business are those who are willing to dive below the surface and think outside the box rather than just follow the book. This approach has gone a long way with our members as we show them new and creative approaches to achieve their goals.

Similarly, we recommend independent agency leadership develop a list of must-have skillsets and traits offered by potential new recruits. Determining the qualities that work best with your workplace culture will make the talent search much more efficient and rewarding.

Recruiting the Next Generation

Once you have identified the ideal job candidate for your agency, its’s time to start recruiting. Where might an agency look to find new talent? There are a few options outside of normal avenues, including:

- Consider other industries: Transferrable skills are critical. We have found considerable success hiring from other industries. For example, a professional in the financial services sector could be a great fit in insurance. These individuals often have the requisite skillsets to work in fast-paced environments and are capable of digesting complex information.

- Expand your recruiting reach: There are plenty of nontraditional means of finding talent today. Veterans can be a great option. They bring ideal skills to insurance and there are many looking for work today. Agencies can also consider parents returning to the workforce or high school students seeking apprenticeships as options.

- Have an on-campus presence: Playing an active role on college campuses, setting up booths at career fairs, and speaking to college students may require a time commitment, but doing so consistently and effectively can introduce young talent to a career path they never considered. Moreover, many of these students are looking for stable career paths, which is a major benefit of our industry. Demonstrate how rewarding a career in insurance can be and how you can support their career and professional development through mentorship.

There are a few tactics to consider to refresh your recruiting efforts and compete with other industries. These may include:

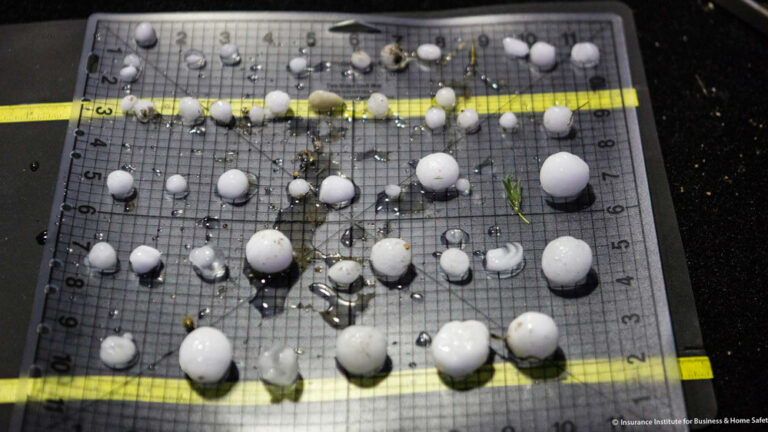

- Present a new story: Traditionally, insurance has not been viewed as particularly dynamic. This is an outdated view and does not represent the scope of our work. Present the story of insurance as it is today, such as how we are regularly on the ground after disasters supporting those in need, how we are driving technology advancements, or how our businesses are very active philanthropically and socially.

- Be visible online: A strong social media presence and a good website make a difference. Young professionals want to work for digitally savvy businesses. Agencies can also use their online presence to showcase their great work, both for clients and for the community.

- Be flexible: Since the pandemic, employees have demanded more flexibility. Work with prospective employees to find what best fits their schedule. If you are looking to hire a working parent, offering a flex or part-time schedule may be attractive. Remote work (or a hybrid remote/office work situation) should also be a consideration in some cases to recruit and retain top talent.

- Consult your colleagues: Other agencies can offer great insights for recruiting talent. Industry leaders can point your agency in the right direction to find additional talent recruiting resources and best practices.

Retaining a Younger Workforce

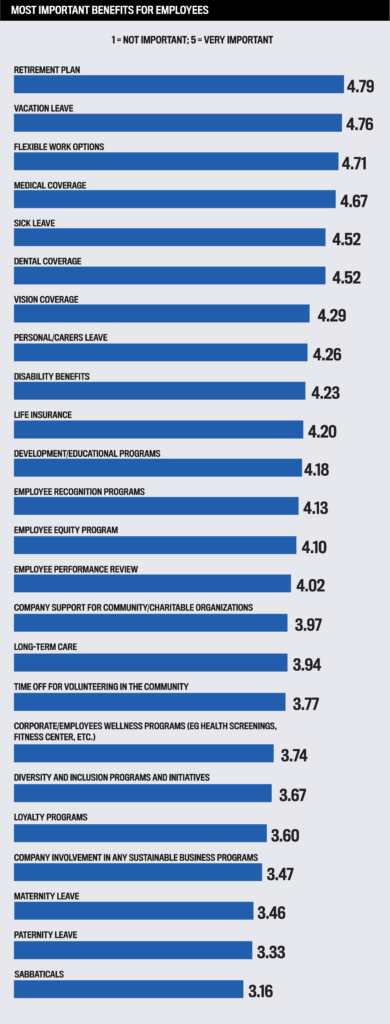

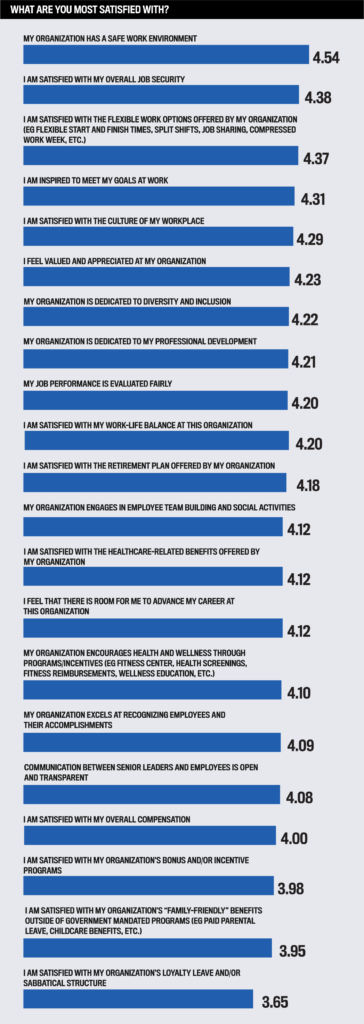

Getting talent in the door is a challenge, but once new insurance professionals have been recruited, we need to do a better job of retaining them. The world of work has changed, and agencies cannot take that for granted. Compensation needs to be more competitive across the board to secure top talent.

Agencies also need to find ways to motivate and inspire their staff members. Beyond financial incentives, an investment in career development can be valuable. Mentorship programs can provide a clear line of sight for team members to see their growth potential, further encouraging them to remain with your organization.

Additionally, soft benefits are often attractive to prospective employees and aid in both recruitment and retention. Some options could include volunteer days off, company service days, paid parental leave or mental health days as well as generous paid-time-off policies.

Agencies looking to grow their staff should intensify their efforts and rethink their recruitment and retention strategies to better position themselves to the next generation of talent.

This article was published in The Standard on January 19, 2024.