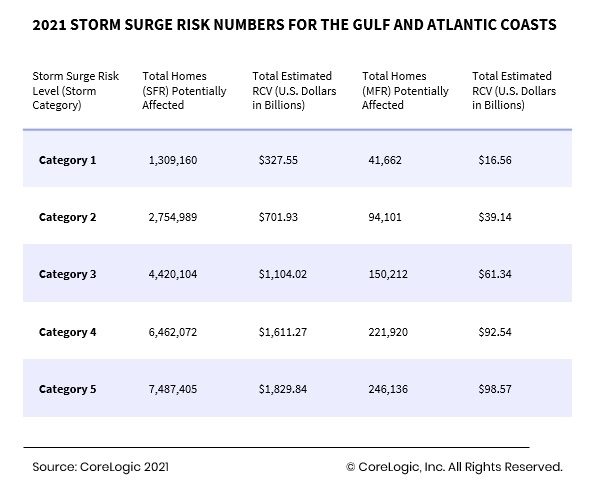

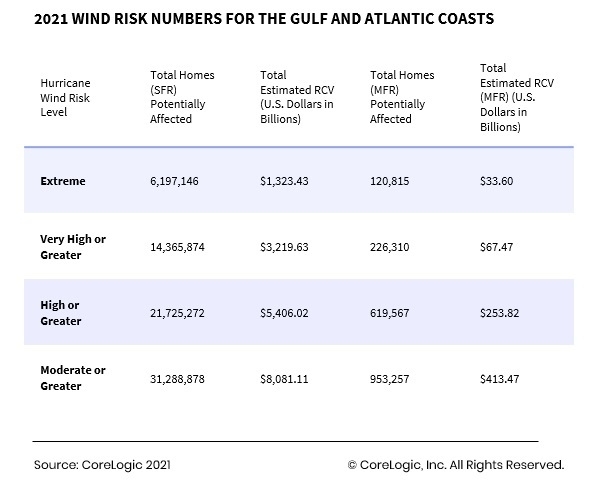

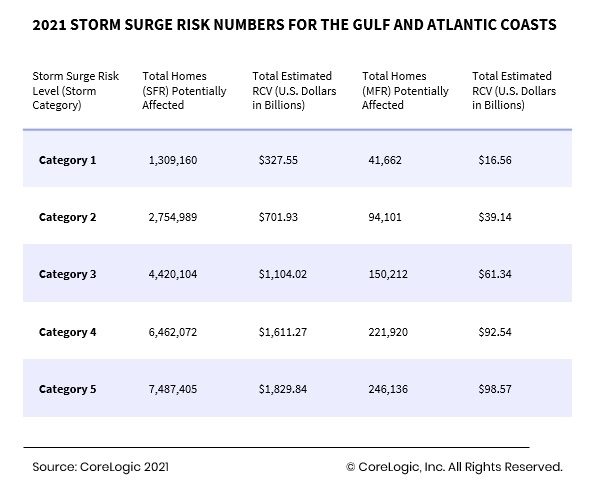

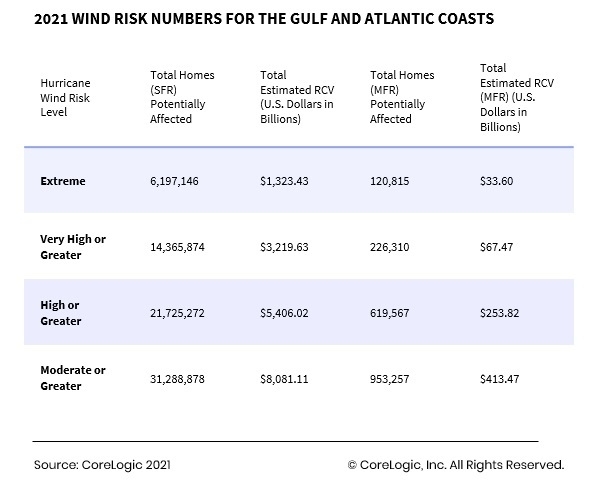

IRVINE, Calif. — CoreLogic® a leading global property information, analytics and data-enabled solutions provider, released its 2021 Hurricane Report, providing analysis of single- and multifamily residences along the Gulf and Atlantic coasts and revealing nearly 8 million homes with more than $1.9 trillion in combined reconstruction cost value (RCV) are at risk of storm surge. This year’s report also examines hurricane wind and reveals more than 31 million homes with nearly $8.5 trillion in combined RCV have moderate or extreme risk exposure to hurricane winds.

With a record high of 30 named storms in the 2020 Atlantic hurricane season and the larger looming impact of climate change, CoreLogic is urging insurers and lenders to prepare for an unpredictable season by shifting the focus from loss adjudication to loss prevention and avoidance. To help mitigate the effects of hurricanes and other natural disasters, it is important to support community resilience goals and understand the risk faced by those impacted.

“To provide a 360-degree view of the impact of climate change, we took a look at the U.S. housing economy after a hurricane strikes and noticed a significant spike in mortgage delinquency rates and loss in housing inventory,” said Frank Nothaft, Chief Economist at CoreLogic. “Communities most affected by natural and financial catastrophe include those with already-high delinquency rates such as in Lake Charles, Louisiana, as reflected in the pre- and post-Hurricane Laura landfall rates.”

Hurricanes, Climate Change and the Impact to Humans

Climate change is significantly affecting the characteristics of hurricanes in the basins that impact the U.S. An increase in frequency and severity of hurricanes with damaging wind, storm surge and flooding will result in the continuation of property losses and increased financial implications on the insurance industry. While wind damages are covered by standard homeowners insurance policies, flood insurance is not consistent. Adoption inside the Special Flood Hazard Areas (SFHA) designated by FEMA is strong, but it’s rarely purchased outside of those zones. In fact, CoreLogic studies have shown that up to 70% of the damages from flood to homes is uninsured.

This means many unsuspecting homeowners could be left with little-to-no protection in recovery from intensifying hurricane seasons. When lower income communities are hit with disaster, it can have long-lasting, compounding effects. Damaged homes, often unsuitable for habitation, may force communities into living situations with new, unplanned-for expenditures. Their place of work may be damaged, locking them out of earning income.

Storm Surge and Hurricane Wind Risk Data

CoreLogic evaluated the storm surge and hurricane wind risk levels for both single-family (SFR) and multifamily (MFR) residences along the Gulf and Atlantic coasts, from Texas up to Maine, for the 2021 hurricane season. Analysis includes the total estimated reconstruction cost value (RCV), which is calculated using the combined cost of construction materials as well as equipment and labor assuming total (100%) destruction of the property.

Metro Implications

CoreLogic looked at the top 15 metropolitan areas with the greatest number of SFR and MFR homes at risk for storm surge and wind damage. The review of the risk counts tells the story of varying risk profiles in the communities we reside in:

- The New York, New York metro area has the greatest risk with 890,430 homes with over $356 billion RCV at risk for storm surge and over 3.8M homes with over $1.6 trillion RCV at risk for hurricane wind.

- The Miami, Florida metro area that includes Miami, Ft. Lauderdale, and West Palm Beach follows the New York Metro area with more than 767,741 homes with over $156 billion RCV at risk for storm surge and over 2M homes with over $422 billion RCV at risk for hurricane wind.

- At a state level, Florida, Louisiana and New York have the greatest number of homes at risk of storm surge and hurricane winds.

“Resilience can be thought of as our ability to recover quickly after a shock, and because we cannot alter the frequency and severity of natural catastrophes, the continuity of our financial system relies upon the expectation of resilient communities,” said Tom Larsen, Principal, Insurance Solutions at CoreLogic. “The current focus is on anticipating what challenges to resilience will be confronting us in the future – a future where we expect more damaging events.”

About CoreLogic

CoreLogic (NYSE: CLGX), the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, buy and protect their homes. For more information, please visit www.corelogic.com.

CORELOGIC, and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries. All other trademarks are the property of their respective owners.