Although Hurricane Henri was downgraded to a tropical storm and narrowly missed densely populated Long Island, New York, Kroll Bond Rating Agency (KBRA) notes the following as we approach the peak of hurricane season:

- An increase in landfall events will continue and further challenge the risk management of property insurers.

- Hurricane Henri, which made landfall as a tropical storm in Rhode Island, will be a relatively minor loss event for the industry. However, insurers who have increased their catastrophe retentions will have earnings declines and experience surplus erosion.

- There will be significant uninsured losses for individual homeowners from storm surge and flooding.

The Winds of Change

The Colorado State University (CSU) Tropical Meteorology Project team—one of the pioneers of hurricane forecasting— updated on August 5 its Atlantic hurricane season forecast, which calls for the sixth consecutive year of above-average activity. In 2021, the Atlantic produced a pre-season storm for the seventh year in a row, following the formation of Tropical Storm Ana on May 22. In the same month, the National Oceanic and Atmospheric Administration (NOAA) released its latest 30-year average, which is re-established every 10 years.1 The average number of named storms, hurricanes, and major hurricanes have continued to increase (see Figure 1). The new 30-year average is over 40% higher for named storms and 60% higher for major hurricanes than the 30-year average from 1971 to 2000. Tropical cyclone activity over the last five years has witnessed a similar trend toward the “new normal.”

| Figure 1: Historical Atlantic Hurricane Seasons |

|

Historical Average |

Hurricane Season Actual Results |

Forecast |

|

1971 – 2000 |

1981 – 2010 |

1991 – 2020 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

| Named Storms |

10.1 |

12.1 |

14.4 |

15 |

17 |

15 |

18 |

30 |

18 |

| Hurricanes |

5.6 |

6.4 |

7.2 |

7 |

10 |

8 |

6 |

13 |

8 |

| Major Hurricanes |

2.0 |

2.7 |

3.2 |

4 |

6 |

2 |

3 |

6 |

4 |

| Sources: Colorado State University, NOAA |

As KBRA previously noted, the 2020 Atlantic hurricane season saw a record-breaking 30 named storms, including 13 hurricanes and six major hurricanes. The number of named storms exhausted the 21 annual pre-designated list of names, with the last nine named storms designated with Greek letters. This was only the second time in history that the Greek alphabet was used; and it will also be the last. Following the 2020 season, the World Meteorology Organization (WMO) decided to discontinue the use of Greek alphabet names if the season’s list of names gets exhausted again. Going forward, they will use a list of 21 supplemental names developed by the WMO,2 which follows the existing English alphabetical naming convention, and suggests the WMO expects the need for more than 21 names in a hurricane season will be more typical than in the past.

As with 2020, named storms in 2021 are far outpacing the historical average (see Figure 2). While CSU’s latest forecast calls for 18 named storms (down from its previous forecast of 20), other forecasts range between 20 and 25. A scenario in which there are 20 named storms would rank 2021 in the top three active hurricane seasons of all time, following 2020 and 2005.

Climate Change and Increased Landfalls

KBRA also notes that while there are differing views within the scientific community as to whether climate change is helping to generate increased frequency of hurricanes, there is general consensus that climate change has contributed to greater storm severity. The Center for Climate and Energy Solutions (C2ES) states that “Although scientists are uncertain whether climate change will lead to an increase in the number of hurricanes, there is more confidence that warmer ocean temperatures and higher sea levels are expected to boost their intensity and impacts. Stronger hurricanes will be far more costly in terms of damages and deaths without action to make coastal (and inland) areas more resilient.”3 Of the 30 named storms in 2020, a record 12 made landfall in the U.S. This trend has continued into 2021, as five of the first eight named storms have made landfall in the U.S. (see Figure 3), and six named storms have made landfall in the Americas.

| Figure 3: 2021 Atlantic Hurricane Season – Named Storms Landfalls |

| Name |

Dates |

Max Wind |

Category |

Landfall |

Geographies Affected |

| Tropical Storm Claudette |

June 19 – June 22 |

45 MPH |

TS |

LA |

AL, GA, LA, MS, NC, SC |

| Tropical Storm Danny |

June 28 – June 29 |

45 MPH |

TS |

SC |

GA, SC |

| Hurricane Elsa |

July 1 – July 9 |

85 MPH |

Cat 1 |

FL |

Caribbean, East Coast U.S. |

| Tropical Storm Fred |

Aug 9 – Aug 20 |

65 MPH |

TS |

FL |

Southeastern & Northeastern U.S. |

| Hurricane Grace |

Aug 13 – Aug 21 |

120 MPH |

Cat 3 |

Mexico |

Caribbean, Mexico |

| Hurricane Henri |

Aug 20 – Aug 23 |

90 MPH |

Cat 1 |

RI |

New England, NY, NJ |

| Sources: NOAA, News Reports, Insurance Information Institute, KBRA |

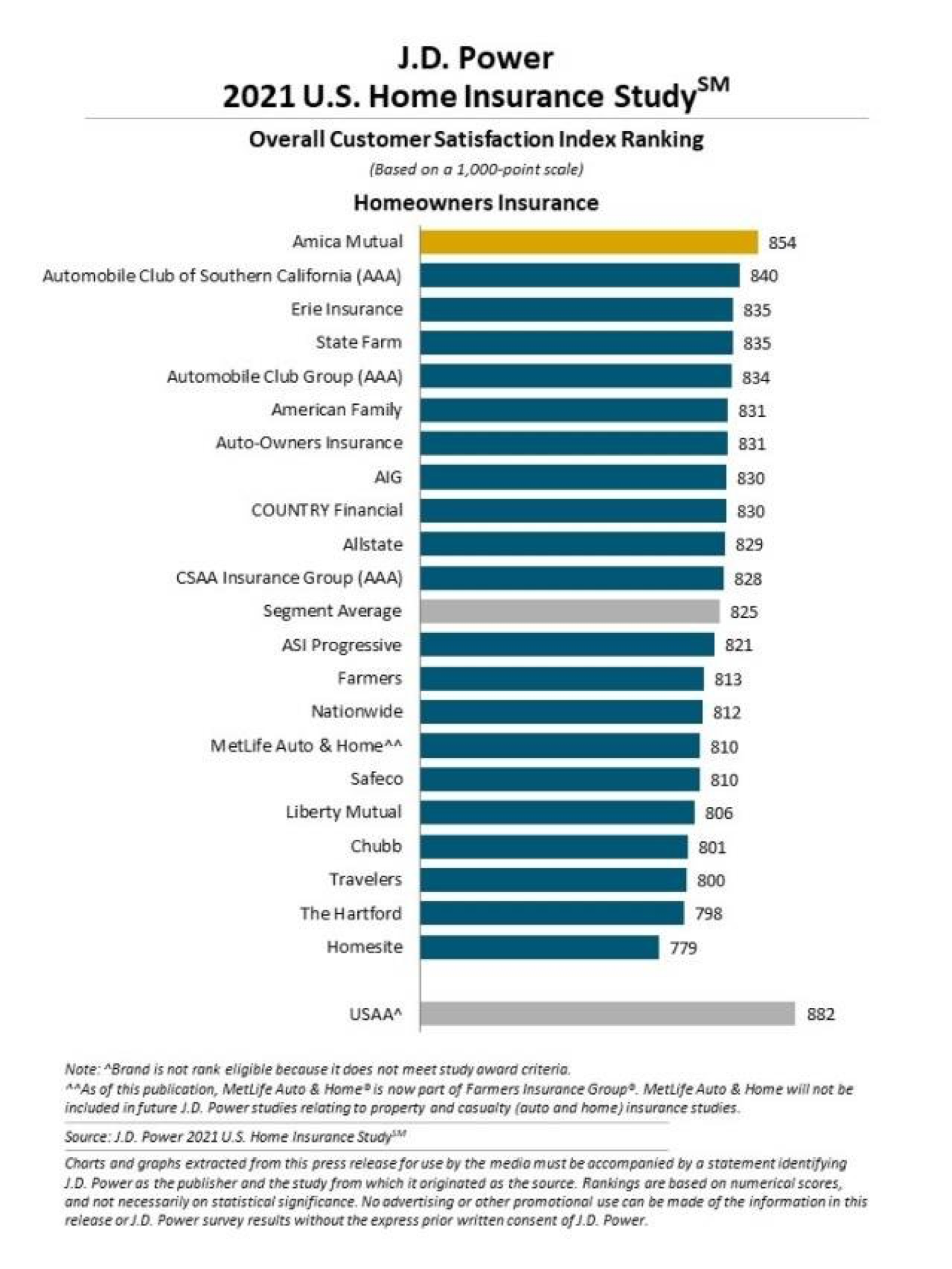

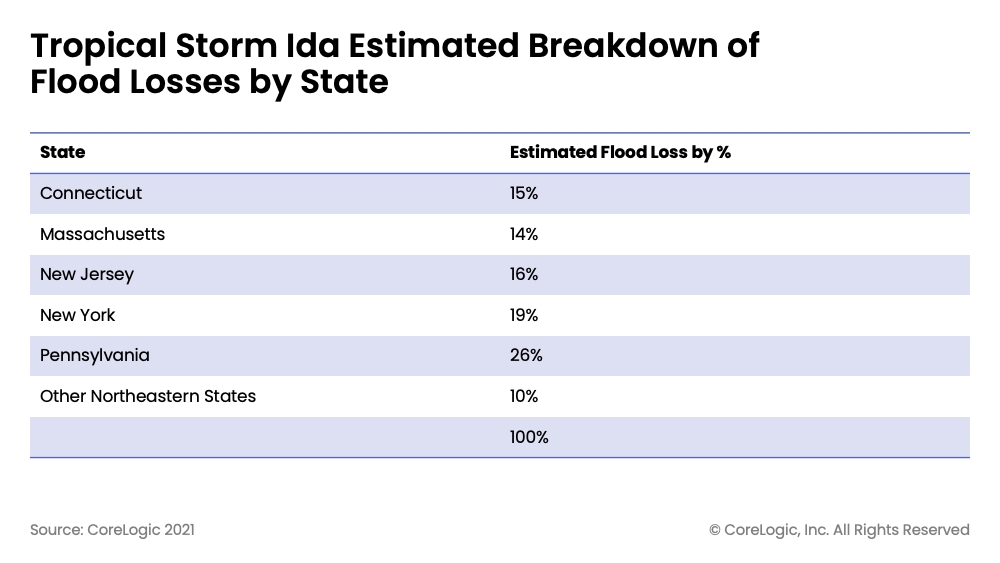

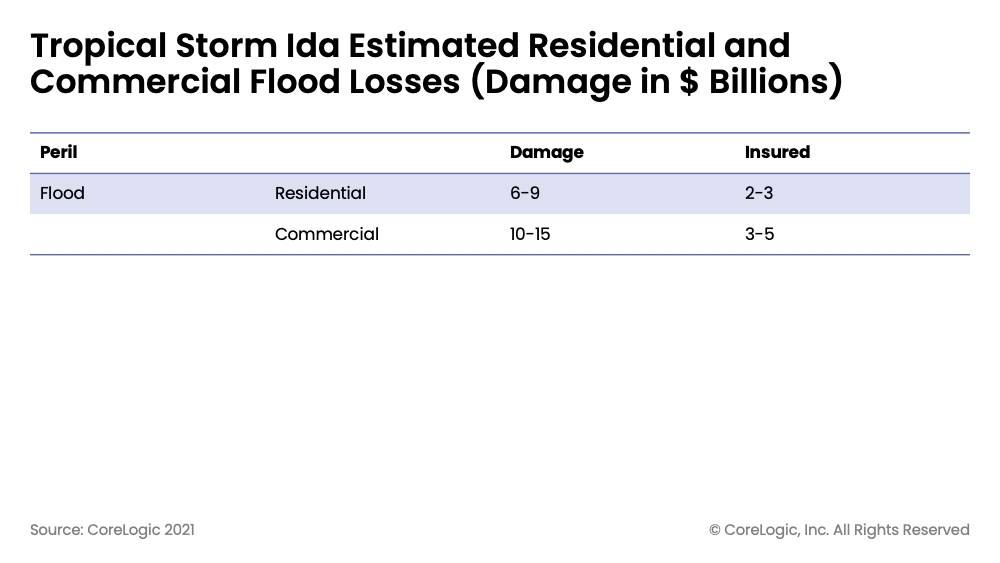

Uninsured Losses Increasing

Due to the significant increase in population, properties, and property values in coastal areas, exposure to flooding (which is often uninsured) is rising—which is likely to drive up flood losses, even in the absence of more frequent and/or more severe flooding events. “After Hurricane Harvey in 2017, CoreLogic estimated that 70% of the flood damage was uninsured,” said Dr. Howard Botts, executive and chief scientist at CoreLogic. Although industry insured loss estimates from Hurricane Henri are likely to be minimal, it is likely that individual homeowners will experience significant uninsured losses from Hurricane Henri, which produced dangerous storm surges and heavy rainfall in parts of Long Island, New York; New Jersey; Connecticut; Massachusetts; and Rhode Island (see Figure 4).

In regard to personal property, standard homeowners insurance does not protect policyholders from flood losses and storm surge, creating a potential coverage gap. Instead, homeowners must rely heavily on the National Flood Insurance Program (NFIP) for coverage from catastrophic flooding. The NFIP allows property owners in certain communities to purchase flood insurance through the federal government. And while homeowners in certain flood zones are mandated to buy flood insurance, in the non-mandated flood zones (which are still exposed to significant flood risk), less than 10% of homeowners purchase an NFIP policy. Furthermore, even for those who purchase NFIP insurance, the amount of coverage is limited and commonly inadequate relative to the value at risk. Going forward, if private flood insurers develop a more robust market for flood insurance, KBRA believes uninsured losses could decline and reduce reliance on the NFIP.

Looking Ahead

Entering 2021, the property/casualty (P/C) insurance industry had achieved record levels of policyholder surplus, which KBRA believes is sufficient to absorb catastrophes similar to those of the past five years, even in combination with a moderate investment downturn. However, elevated catastrophe activity over the past five years has steadily driven reinsurance pricing higher and some primary insurers with unfavorable loss experience chose to restructure their reinsurance programs to manage sharply rising costs. In some cases, retentions were increased, while total limits were reduced. If the recent pattern of active hurricane seasons has ushered in a new normal of natural catastrophes, P/C insurers (especially smaller regional companies) will need to redouble their focus on underwriting profitability and risk management to protect their financial strength.

Related Reports

© Copyright 2021, Kroll Bond Rating Agency, LLC and/or its affiliates and licensors (together, “KBRA”). All rights reserved. All information contained herein is proprietary to KBRA and is protected by copyright and other intellectual property law, and none of such information may be copied or otherwise reproduced, further transmitted, redistributed, repackaged or resold, in whole or in part, by any person, without KBRA’s prior express written consent. Information, including any ratings, is licensed by KBRA under these conditions. Misappropriation or misuse of KBRA information may cause serious damage to KBRA for which money damages may not constitute a sufficient remedy; KBRA shall have the right to obtain an injunction or other equitable relief in addition to any other remedies. The statements contained herein are based solely upon the opinions of KBRA and the data and information available to the authors at the time of publication. All information contained herein is obtained by KBRA from sources believed by it to be accurate and reliable; however, all information, including any ratings, is provided “AS IS”. No warranty, express or implied, as to the accuracy, timeliness, completeness, merchantability, or fitness for any particular purpose of any rating or other opinion or information is given or made by KBRA. Under no circumstances shall KBRA have any liability resulting from the use of any such information, including without limitation, for any indirect, special, consequential, incidental or compensatory damages whatsoever (including without limitation, loss of profits, revenue or goodwill), even if KBRA is advised of the possibility of such damages. The credit ratings, if any, and analysis constituting part of the information contained herein are, and must be construed solely as, statements of opinion and not statements of fact or recommendations to purchase, sell or hold any securities. KBRA receives compensation for its rating activities from issuers, insurers, guarantors and/or underwriters of debt securities for assigning ratings and from subscribers to its website. Please read KBRA’s full disclaimers and terms of use at www.kbra.com.

______________________________

1 https://www.accuweather.com/en/hurricane/average-hurricane-season-has-a-new-normal/905558

2 https://weather.com/storms/hurricane/news/2021-03-15-hurricane-laura-dorian-names-retired-wmo

3 https://www.c2es.org/content/hurricanes-and-climate-change/